A penny saved is a penny earned- but it’s just a penny: The importance of investing your savings

A quick guide for those looking to start investing

Picture this; you’re sipping a drink you don’t know how to pronounce, with waves crashing on the beach, and sun in your face. Or if that’s not really your scene, driving a Ferrari with the top down, wind smacking your face, doing 100 miles per hour. If you like the sound of that then I have the answer to achieving your dreams and reaching financial security: investing. Now, I can’t guarantee you will be sitting on that beach or driving that Ferrari, but I will tell you that this is your best chance for an average person.

What does it mean to Invest?

Before we dive into Investing 101, we must grasp what it means to invest. The Investopedia definition of investing reads: “the act of allocating resources, usually money, with the expectation of generating an income or profit”. You can invest in endeavors, such as using money to start a business, or in assets, such as purchasing real estate in hopes of reselling it later at a higher price. In layman’s terms, investing is giving money in exchange for a chance to have more money in the future.

Importance of Investing

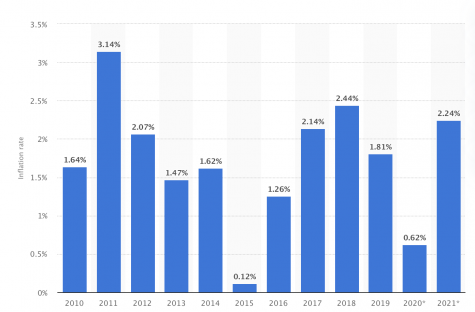

Now I’m sure you’re wondering why investing is so important. Why wouldn’t I just keep the money I have under my mattress and not risk losing it? My answer to that is inflation. Inflation is the depreciation of monetary value. Basically, this means that the money under your mattress that is so precious to you is getting less and less valuable every day. The inflation rate over the past 10 years has a range of 0.12 percent to 3.14 percent with an average of around 1.71 percent a year. So, if 10 years ago I started off with 10,000 dollars under my mattress in 2020 that money would only be worth about 8570 dollars.

Let’s take a look at the richest people in the world: Jeff Bezos, Bill Gates, and Elon Musk. There are many similarities between the three, such as going to top tier Ivy League schools, founding their own companies, and abolishing their 9–5 job schedule. No one ever became super wealthy working a 9–5 job without investing; the recipe to success is to make money in your sleep. Now I’m not saying to quit your job, but you shouldn’t just be saving all of that money from your job, you should be investing it. Let’s take a look at a consultant who works 9–5 Monday to Friday and earns about 100,000 per year after tax. Now, let’s clone this consultant, but our copy invests 25 percent of their income (25,000 dollars) per year and the original keeps it under their mattress. After 10 years, the original consultant would have 1,250,000 dollars, while the copy who invested would have about $1,440,000 dollars (assuming an average annual return of 10 percent). That extra 200,000 can buy you that Ferrari.

Introduction to Investing Strategies

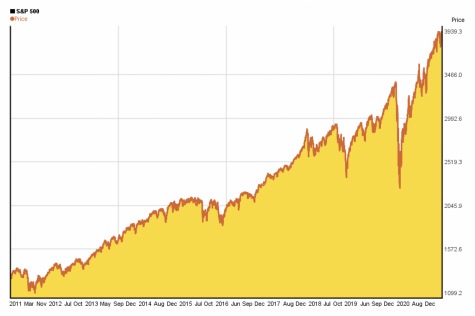

So now that you know why just keeping your money under the mattress is not a good idea, let’s dive into how you can double or triple that money. I would recommend buying an index such as the S&P 500 for beginners that are getting into investing. The S&P 500 is a stock market index that measures the performance of 500 large-cap companies listed on the United States stock exchanges. It is one of the most common indexes that people invest in because it is a broad- based index covering all sectors of the U.S. economy. For beginners this is the perfect way to start your investing career as it allows for diversification, which is an important tool for early investors.

Now that we covered why investing is important and briefly touched on the S&P 500, I’m sure you’re wondering what the benefits of investing that money are and when you will be able to reap the benefits of your smart investing decisions. Imagine, for instance, you invested in the S&P 500 on January 1, 2010 when the index was around 1,115 and you sold on January 1, 2020 when the index was around 3,230. You would have almost tripled your money with about a 190 percent increase.

Successful Investors

Warren Buffett, the fourth richest man in the world and the founder of Berkshire Hathaway, is considered one of the most successful investors in the world. His exploits include a net worth of $85.6 billion, and he is well-known for his positions in Coca-Cola, Dairy Queen, and Goldman Sachs. He has recently taken stock in technology companies, such as Apple, and most recently a company called Snowflake, a cloud-based data-warehousing company that was founded in 2012. He is well known for his investing strategy of value investing, a tactic made famous by Benjamin Graham in the 1920s. Value investing focuses on selecting stocks that an investor feels are undervalued or believes that the market has over- or under-reacted to recent events. These investors bet on the long-term growth of the company and strongly believe in the company’s fundamentals, believing that the fundamentals of the company correlate to the way the world is changing.

What is Value vs. Growth Investing?

Another investing strategy is growth investing where an investor takes a position in a company based on the expectation of high growth in a particular sector or a specific company. While in value investing investors select undervalued stocks and hope that the market will correct its undervaluation. In growth investing investors look for companies with a proven track record, consistent growth over many years, and show strong earnings for years to come. Investors in growth investing also believe that the fundamentals of the companies align with the way the world is evolving.

Although I can’t guarantee you will be living on the beach or driving a Ferrari, I can guarantee the knowledge you will gain from investing will get you the most out of the money under the mattress and it will go to better use than just being an extra layer in your mattress.